Real Estate Investment Tips takes center stage in this guide, offering insights on how investing in real estate can lead to wealth creation. Get ready to dive into the world of real estate investment with a fresh perspective that’s both informative and exciting.

Importance of Real Estate Investment

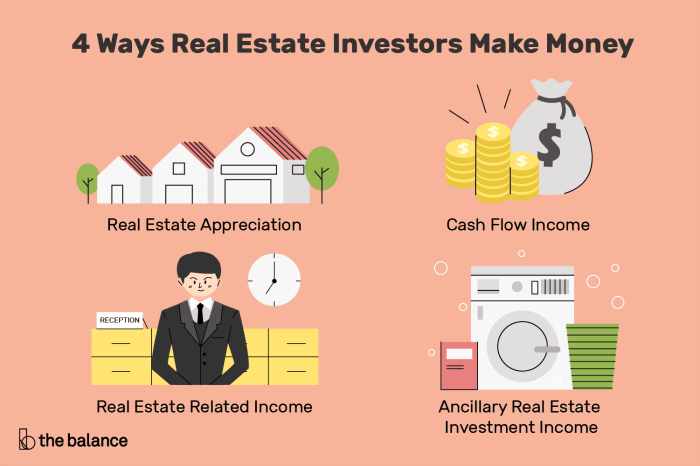

Investing in real estate is crucial for building wealth and securing financial stability for the future. Real estate investment offers a wide range of benefits that make it a valuable addition to any investment portfolio.

Building Wealth through Real Estate Investment

- Real estate properties tend to appreciate over time, allowing investors to generate profit through capital gains.

- Rental income from investment properties provides a steady cash flow, creating a passive income stream.

- Investors can leverage their real estate assets to acquire additional properties, further expanding their investment portfolio.

Advantages of Real Estate Investment

- Real estate investments offer a tangible asset that provides more stability compared to volatile stock markets.

- Investors can benefit from tax advantages such as deductions for mortgage interest, property depreciation, and property taxes.

- Diversifying investment portfolios with real estate can help reduce overall risk and increase long-term returns.

Types of Real Estate Investments

Investing in real estate can take many forms, each with its own set of advantages and disadvantages. Understanding the different types of real estate investments is crucial for making informed decisions about where to put your money.

Residential Real Estate

Residential real estate involves properties that are used for living purposes, such as single-family homes, apartments, or condominiums. Investing in residential real estate can provide a steady income stream through rental payments, but it may also require more hands-on management compared to other types of investments.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, and warehouses. Investing in commercial real estate can offer higher rental yields and longer lease terms, but it may also come with higher operating costs and risks.

Industrial Real Estate

Industrial real estate comprises properties used for manufacturing, production, or storage, such as factories, distribution centers, and industrial parks. Investing in industrial real estate can provide stable cash flows and long-term tenants, but it may require specialized knowledge and expertise.

Short-Term vs. Long-Term Investments

Short-term real estate investments typically involve buying properties with the intention of selling them quickly for a profit, also known as “flipping.” Long-term investments, on the other hand, involve holding onto properties for an extended period of time to generate rental income and potential appreciation.

Pros and Cons

- Residential Real Estate: Pros include steady income and high demand, but cons may include tenant turnover and property maintenance.

- Commercial Real Estate: Pros include higher rental yields and longer leases, but cons may include economic risks and tenant vacancies.

- Industrial Real Estate: Pros include stable cash flows and long-term tenants, but cons may include market volatility and operational challenges.

Factors to Consider Before Investing

Investing in real estate can be a lucrative opportunity, but it’s essential to carefully consider several key factors before making a decision. Conducting thorough research and evaluating important aspects of the property and market can help you make informed investment choices.

Market Research Tips

Before investing in real estate, it’s crucial to conduct comprehensive market research to understand the current trends and potential opportunities. Here are some tips to consider:

- Look at the local real estate market trends to determine if it’s a buyer’s or seller’s market.

- Assess the demand for rental properties in the area to gauge potential rental income.

- Consider factors like job growth, population growth, and economic stability to determine the long-term viability of the investment.

- Consult with local real estate agents and professionals to gain insights into the market dynamics and investment potential.

Importance of Location

The location of a property plays a significant role in its investment potential. Factors to consider include:

- Proximity to amenities such as schools, hospitals, shopping centers, and public transportation can increase the property’s value.

- Accessibility to major highways and transportation hubs can attract tenants and buyers, enhancing the property’s marketability.

- Research the neighborhood and assess the safety, crime rates, and overall desirability of the location for potential tenants or buyers.

Property Condition and Market Trends

The condition of the property and current market trends can greatly impact your investment decision. Consider the following:

- Inspect the property thoroughly for any structural issues, needed repairs, or renovation requirements that may affect the overall investment cost.

- Stay updated on market trends and forecasts to anticipate potential changes in property values, rental rates, and demand in the area.

- Evaluate the potential for property appreciation over time based on historical data and future projections.

Financing Real Estate Investments

Investing in real estate can be a lucrative venture, but securing financing is crucial for making it happen. There are various options available for financing real estate investments, each with its own advantages and considerations.

Different Financing Options

- Mortgage: One of the most common ways to finance real estate investments is through a mortgage. This involves borrowing money from a lender to purchase a property, with the property serving as collateral.

- Cash: Paying for a property in cash eliminates the need for financing, but it requires a significant upfront investment. Cash buyers often have an advantage in negotiations and can close deals quickly.

- Hard Money Loans: These are short-term, high-interest loans typically used by real estate investors to finance renovation projects or properties that do not qualify for traditional financing.

Tips for Securing Financing

- Maintain a good credit score: Lenders consider your credit score when determining loan eligibility and interest rates. Aim to improve your credit score before applying for financing.

- Prepare a solid business plan: Presenting a detailed business plan that Artikels your investment goals, strategies, and financial projections can help you secure financing.

- Shop around for the best rates: Compare different lenders and loan options to find the most favorable terms for your real estate investment.

Importance of Budgeting and Financial Planning

- Creating a budget and financial plan is essential for successful real estate investing. It helps you determine how much you can afford to invest, manage expenses, and maximize profits.

- Financial planning also allows you to set realistic goals, track your progress, and make informed decisions about your real estate investments.

- By budgeting and planning carefully, you can mitigate risks, optimize returns, and build a sustainable real estate investment portfolio.

Real Estate Investment Strategies: Real Estate Investment Tips

Real estate investment strategies are crucial for success in the industry. Different strategies offer varying levels of risk and reward, catering to different investor preferences and goals.

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties with the intention of holding onto them for an extended period. Investors aim to generate passive income through rental payments and benefit from property appreciation over time.

- Low risk due to long-term investment horizon

- Potential for steady cash flow from rental income

- Opportunity for long-term wealth accumulation through property appreciation

Fix and Flip Strategy, Real Estate Investment Tips

The fix and flip strategy involves purchasing distressed properties, renovating them, and selling them for a profit in a short period. Investors focus on adding value to the property through renovations and improvements.

- Higher risk due to shorter investment horizon and market fluctuations

- Potential for quick returns on investment through property value appreciation

- Requires expertise in property renovation and market analysis

Rental Properties Strategy

Rental properties strategy involves purchasing properties to rent them out to tenants. Investors earn income through monthly rental payments and have the potential for long-term wealth accumulation through property appreciation.

- Stable cash flow through rental income

- Potential for long-term wealth accumulation through property appreciation

- Requires property management skills and tenant relationship management

Successful Real Estate Investment Strategies

Successful real estate investment strategies often involve a combination of the above strategies tailored to specific market conditions and investor goals. For example, a successful investor may utilize a buy and hold strategy for long-term wealth accumulation while also engaging in fix and flip projects for quicker returns.

Managing Real Estate Investments

Managing real estate investments requires careful attention to detail and a proactive approach to ensure the success of your investment. Proper property management is essential for maximizing returns and maintaining the value of your real estate portfolio.

Importance of Maintenance

- Regular maintenance of your properties is crucial to preserve their value and attract quality tenants.

- Addressing maintenance issues promptly can prevent costly repairs down the line and ensure tenant satisfaction.

- Regular inspections and upkeep can help extend the lifespan of your property and reduce vacancies.

Tenant Screening and Lease Agreements

- Thorough tenant screening is key to finding reliable tenants who will pay rent on time and take care of your property.

- Having a detailed lease agreement in place can protect your interests and Artikel tenant responsibilities.

- Regular communication with tenants can help address any issues quickly and maintain a positive landlord-tenant relationship.

Dealing with Common Challenges

- Handling tenant complaints and disputes professionally and promptly can help prevent escalation and maintain a peaceful living environment.

- Staying informed about local rental laws and regulations is essential to avoid legal issues and protect your investment.

- Working with reliable contractors and service providers can ensure timely maintenance and repairs, reducing downtime and expenses.