Passive Income Ideas sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

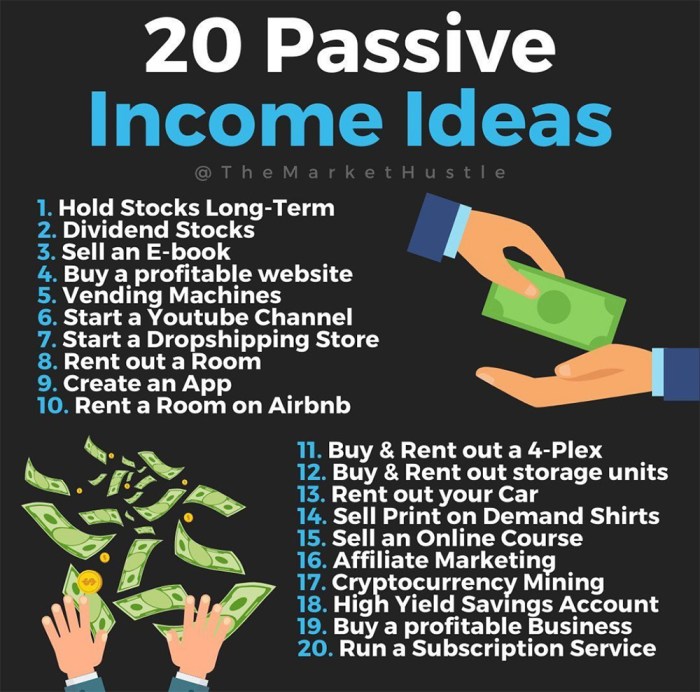

From real estate investments to online business ventures and stock market strategies, this guide will show you how to generate passive income and secure your financial stability.

Introduction to Passive Income Ideas

Passive income is money earned with minimal to no effort on the part of the recipient. This type of income is generated from assets or activities that require little maintenance once set up, allowing individuals to earn money even while they sleep.

There are several benefits to generating passive income. Firstly, it provides financial freedom by allowing individuals to earn money without being tied to a traditional 9-5 job. Passive income streams can also help individuals build wealth over time and achieve financial goals more quickly. Additionally, passive income can provide a sense of security and stability, as it creates a cushion in case of unexpected financial setbacks.

The Importance of Diversifying Income Streams, Passive Income Ideas

Diversifying income streams is crucial for financial stability. Relying on a single source of income can be risky, as it leaves individuals vulnerable to economic downturns or job loss. By diversifying income streams and creating multiple sources of passive income, individuals can better protect themselves against financial uncertainty and build a more secure financial future.

Real Estate Investments

Real estate can be a lucrative source of passive income due to the potential for rental income, property appreciation, and tax benefits. Investing in real estate can provide a steady stream of income without requiring constant active involvement.

Passive Income Streams in Real Estate

- Rental Properties: Investing in rental properties allows you to earn passive income through monthly rent payments from tenants.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. By investing in REITs, you can earn dividends without directly owning physical properties.

- Airbnb Rentals: Renting out properties on platforms like Airbnb can also generate passive income through short-term rentals.

Pros and Cons of Investing in Real Estate for Passive Income

- Pros:

Steady Income: Rental properties can provide a consistent source of income.

Property Appreciation: Real estate has the potential to increase in value over time, allowing for capital gains.

Tax Benefits: Real estate investors can take advantage of tax deductions, depreciation, and other incentives.

- Cons:

High Initial Investment: Purchasing real estate typically requires a significant upfront investment.

Property Management: Managing rental properties can be time-consuming and may involve dealing with tenant issues.

Market Risk: Real estate values can fluctuate based on market conditions, impacting investment returns.

Online Business Ventures: Passive Income Ideas

Online business ventures are a popular way to generate passive income in today’s digital age. With the right idea and strategy, you can create a successful online business that earns money while you sleep.

Creating an online business for passive income involves identifying a niche market, developing a product or service, setting up a website or online store, driving traffic to your site, and implementing strategies to convert visitors into customers. It requires initial hard work and dedication but can eventually lead to a steady stream of passive income.

Different Online Business Ideas

- Dropshipping: Start an online store without holding inventory. When a customer makes a purchase, the product is shipped directly from the supplier.

- Affiliate Marketing: Promote other companies’ products and earn a commission for every sale made through your referral.

- Print on Demand: Design and sell custom products like t-shirts, mugs, and phone cases without holding inventory.

Platforms for Selling Products/Services Passively

- Amazon FBA (Fulfillment by Amazon): Sell products through Amazon, and they handle storage, packing, and shipping.

- Etsy: A marketplace for handmade or vintage items, as well as craft supplies. It allows you to reach a niche audience interested in unique products.

- Shopify: Build an online store with customizable templates, secure payment options, and marketing tools to reach customers worldwide.

Stock Market Investments

Investing in the stock market can be a great way to generate passive income through various strategies like dividend-paying stocks, index funds, and ETFs.

Dividend-Paying Stocks

- Dividend-paying stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends.

- Investors can earn passive income by holding onto these stocks and receiving regular dividend payments.

- Companies with a history of consistent dividend payments are often seen as stable and reliable investments.

Index Funds and ETFs

- Index funds are mutual funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500.

- Investing in index funds or ETFs allows investors to passively track the performance of the overall market, reducing the need for active management.

- These funds are diversified, providing exposure to a broad range of stocks and reducing individual stock risk.

Tips for Beginners

- Start by educating yourself about the basics of the stock market and different investment options available.

- Consider working with a financial advisor to create a solid investment plan tailored to your financial goals and risk tolerance.

- Diversify your portfolio by investing in a mix of stocks, bonds, and other assets to spread out risk.

- Regularly review and rebalance your portfolio to ensure it aligns with your investment objectives and risk tolerance.