Kicking off with Real Estate Investing Tips, this opening paragraph is designed to captivate and engage the readers, bringing you the latest insights on how to navigate the real estate investment landscape like a pro. From finding hidden gems to strategies for success, buckle up for a ride into the world of lucrative real estate investments.

Introduction to Real Estate Investing

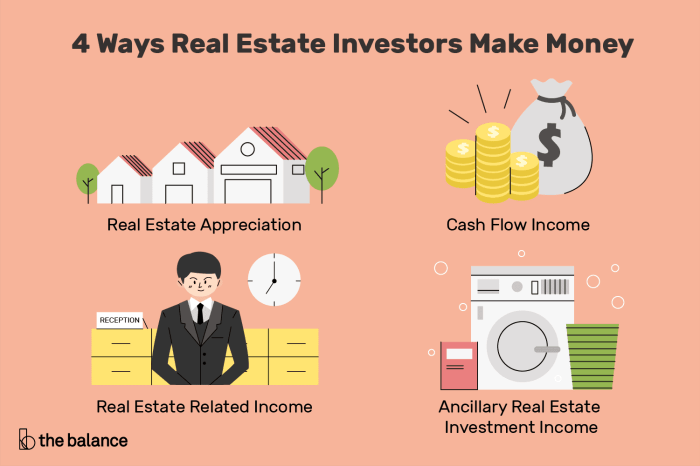

Real estate investing involves purchasing, owning, managing, renting, or selling properties for profit. It can include residential, commercial, or industrial properties.

Real estate investing offers several benefits, including potential for high returns, passive income through rental properties, tax advantages, portfolio diversification, and a hedge against inflation.

Real estate is a popular investment choice due to its tangible nature, potential for appreciation over time, ability to generate cash flow, and the sense of security that comes with owning physical assets.

Types of Real Estate Investments

Investing in real estate offers a variety of options to choose from, each with its own set of risks and rewards. Let’s explore the different types of real estate investments and the strategies that can lead to success.

Residential Real Estate

Residential real estate involves properties such as single-family homes, condos, and townhouses that are used for living purposes. One common strategy for success in residential real estate is house flipping, where investors purchase properties at a lower price, renovate them, and sell them for a profit.

Commercial Real Estate

Commercial real estate includes properties like office buildings, retail spaces, and warehouses that are used for business purposes. Investing in commercial real estate can be lucrative, but it also carries higher risks due to factors like economic downturns and market fluctuations. One successful strategy in commercial real estate is leasing properties to established businesses for long-term, stable income.

Industrial Real Estate

Industrial real estate comprises properties like factories, warehouses, and distribution centers. This type of investment can provide steady income streams, especially when leased to reliable tenants. However, industrial real estate investments require careful consideration of factors like location, demand, and market trends to mitigate risks.

Factors to Consider Before Investing in Real Estate

Before diving into real estate investments, it is crucial to carefully consider several key factors that can greatly impact the success of your venture. From location to market trends, property condition, and growth potential, here are some important aspects to keep in mind.

Location

When it comes to real estate, location is everything. A prime location can significantly increase the value of your property and attract potential tenants or buyers. Factors to consider include proximity to amenities, schools, transportation, and the overall neighborhood vibe.

Market Trends

Staying informed about current market trends is essential for making informed investment decisions. Researching factors like supply and demand, rental rates, property appreciation, and economic indicators can help you anticipate market movements and adjust your strategy accordingly.

Property Condition

Before purchasing a property, it is important to thoroughly assess its condition. Consider hiring a professional inspector to identify any potential issues that may require costly repairs or renovations. A property in good condition can save you money in the long run and attract higher-quality tenants.

Potential for Growth

Investing in real estate is not just about the present; it’s also about the future. Evaluate the potential for growth in the area where you are considering investing. Look for signs of development, infrastructure improvements, and job opportunities that could increase the value of your property over time.

Setting Financial Goals and Budgeting

Before making any real estate investment, it is crucial to set clear financial goals and create a budget. Determine how much you are willing to invest, calculate potential returns, and establish a realistic timeline for achieving your investment objectives. Having a clear financial plan can help you stay on track and make informed decisions throughout the investment process.

Tips for Successful Real Estate Investing

Investing in real estate can be a lucrative venture if done right. Here are some tips to help you succeed in the real estate market.

Finding Undervalued Properties

When looking for undervalued properties, consider the following tips:

- Look for properties in up-and-coming neighborhoods that have the potential for growth.

- Attend foreclosure auctions or look for distressed properties that can be renovated for a profit.

- Utilize online real estate platforms and networks to find properties that are priced below market value.

Importance of Due Diligence

Due diligence is crucial in real estate investing to avoid costly mistakes. Here are some strategies to ensure you do your due diligence:

- Research the local market trends and property values in the area you are interested in investing.

- Inspect the property thoroughly for any structural issues or potential problems that may arise in the future.

- Review all legal documents related to the property, including title deeds, zoning regulations, and any existing liens.

Negotiating Deals and Maximizing Returns

Negotiating deals effectively can help you maximize returns on your real estate investments. Consider the following tips:

- Start by making a reasonable offer based on your research and the property’s condition.

- Be prepared to walk away from a deal if the terms are not favorable or if the seller is not willing to negotiate.

- Consider using creative financing options or strategies to make the deal more attractive to the seller.

Real Estate Investment Risks and How to Mitigate Them: Real Estate Investing Tips

Investing in real estate comes with its own set of risks that can impact the success of your investments. Understanding these risks and knowing how to mitigate them is crucial for any real estate investor.

Market Fluctuations, Real Estate Investing Tips

Market fluctuations can significantly impact the value of your real estate investments. To mitigate this risk, it’s important to diversify your portfolio across different types of properties and locations. By spreading out your investments, you can reduce the impact of market fluctuations on your overall returns.

Unexpected Expenses

Unexpected expenses, such as major repairs or vacancies, can eat into your profits from real estate investments. One way to mitigate this risk is by setting aside a reserve fund specifically for these unforeseen costs. This fund can help cover expenses without impacting your cash flow or forcing you to sell the property at a loss.

Property Management Issues

Managing rental properties can be challenging, especially if you encounter difficult tenants or maintenance issues. To mitigate this risk, consider hiring a professional property management company to handle the day-to-day operations of your properties. This can help ensure that your investments are well-maintained and that any issues are addressed promptly.

Interest Rate Changes

Fluctuations in interest rates can impact your financing costs and overall profitability. To mitigate this risk, consider locking in a fixed-rate mortgage to protect yourself from sudden increases in interest rates. This can provide stability to your cash flow and make it easier to predict your returns.

Legal and Regulatory Changes

Changes in laws and regulations can have a significant impact on real estate investments. To mitigate this risk, stay informed about any upcoming changes in the legal landscape that could affect your properties. Consulting with legal professionals can help you navigate these changes and ensure that your investments remain compliant with all regulations.