First-Time Home Buying Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Embark on a journey filled with valuable insights and expert advice on navigating the complex world of purchasing your first home.

Importance of Research

Research is a crucial step before buying a home as it helps first-time homebuyers make informed decisions and avoid potential pitfalls in the process.

Types of Research

- Neighborhood Research: Investigate the safety, amenities, schools, and future development plans in the area you are considering.

- Market Research: Understand the current housing market trends, prices, and the potential for appreciation in the future.

- Financial Research: Determine your budget, mortgage options, and additional costs like property taxes and insurance.

- Home Inspection Research: Hire a professional to inspect the property for any potential issues or repairs needed.

Benefits of Research

Research allows you to:

- Make an informed decision based on facts and data.

- Avoid overpaying for a property that may not be worth its value.

- Understand the long-term investment potential of the property.

- Be prepared for any unexpected costs or issues that may arise during the home buying process.

Financial Preparation

Being financially prepared is crucial for first-time homebuyers to ensure a smooth and successful home buying process. It involves assessing your current financial situation, setting a budget, and exploring different financing options to determine the best fit for your needs.

Key Financial Factors to Consider

- Calculate your budget: Determine how much you can afford to spend on a home by considering your income, expenses, debts, and savings.

- Check your credit score: A good credit score is essential for qualifying for a mortgage with favorable terms. Monitor your score and work on improving it if needed.

- Saving for a down payment: Saving for a down payment is a significant part of buying a home. Aim to save at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI).

- Consider additional costs: In addition to the down payment, factor in closing costs, property taxes, homeowners insurance, and maintenance expenses into your budget.

Comparison of Financing Options

- Conventional Loans: Offered by private lenders, conventional loans typically require a higher credit score and down payment but may have more flexible terms.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans are popular among first-time buyers due to their lower down payment requirements and more lenient credit score criteria.

- VA Loans: Reserved for veterans, active-duty service members, and eligible spouses, VA loans offer competitive interest rates and require no down payment.

- USDA Loans: Designed for rural homebuyers, USDA loans offer low to no down payment options for eligible properties in designated rural areas.

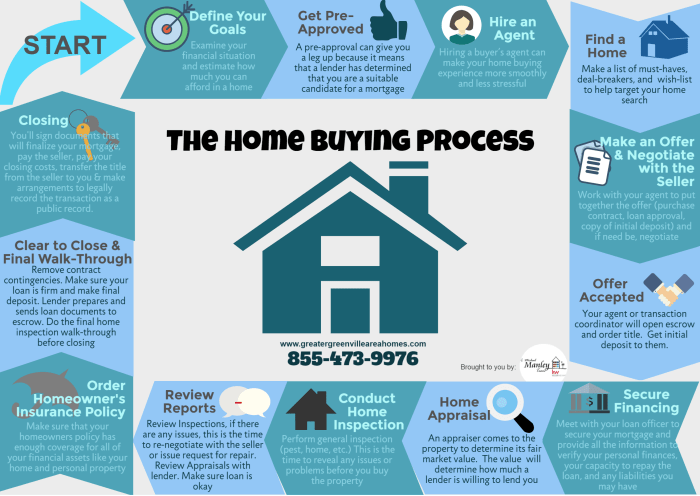

Understanding Home Buying Process

Buying a home for the first time can be a daunting task, but understanding the process can make it much smoother. From finding the right property to closing the deal, there are several steps involved in purchasing a home.

Step-by-Step Process of Buying a Home

- Get pre-approved for a mortgage to determine your budget.

- Start house hunting and attend open houses to find the perfect home.

- Make an offer and negotiate with the seller.

- Get a home inspection to uncover any issues with the property.

- Finalize the mortgage and prepare for the closing process.

Role of a Real Estate Agent, First-Time Home Buying Tips

A real estate agent plays a crucial role in the home buying process. They help you navigate the market, find properties that meet your criteria, negotiate offers, and guide you through the closing process.

Common Pitfalls to Avoid

- Not getting pre-approved for a mortgage before house hunting.

- Skipping the home inspection and missing potential issues.

- Overextending your budget and getting into financial trouble.

- Not understanding the terms of the contract and facing legal issues.

Finding the Right Property

Finding the perfect property as a first-time homebuyer can be overwhelming, but with the right approach, you can make a wise investment that meets your needs and budget.

Significance of Location, Amenities, and Future Resale Value

When looking for the right property, consider the location carefully. A good neighborhood with access to essential amenities like schools, hospitals, and shopping centers can enhance your quality of life and attract potential buyers in the future. Additionally, properties with good resale value are crucial, as you want your investment to grow over time.

- Location is key: Choose a property in a safe and convenient neighborhood.

- Consider amenities: Look for properties near parks, public transportation, and other amenities that add value.

- Think about future resale value: Research the market trends and choose a property that is likely to appreciate in value.

Strategies for Negotiating a Fair Price

Negotiating the price for your chosen property is a crucial step in the home buying process. By using the right strategies, you can secure a fair deal that works for both you and the seller.

- Do your research: Understand the market value of similar properties in the area to negotiate from an informed position.

- Get a pre-approval: Having a mortgage pre-approval can show sellers that you are a serious buyer and give you an edge in negotiations.

- Be willing to walk away: Don’t be afraid to walk away if the price is not right. Sometimes, this can prompt the seller to reconsider their offer.

Home Inspection and Appraisal: First-Time Home Buying Tips

When buying a home, it’s crucial to prioritize a thorough home inspection and appraisal to ensure you’re making a wise investment. These steps can uncover any hidden issues with the property and provide an accurate valuation, helping you make an informed decision.

Importance of Home Inspection

A home inspection is a detailed examination of the property’s condition, including its structure, plumbing, electrical systems, and more. As a first-time buyer, it’s essential to look for a qualified inspector who can identify any potential problems that may not be immediately apparent.

- Inspect the roof for any signs of damage or wear that may require repairs.

- Check the foundation for cracks or moisture issues that could indicate structural issues.

- Examine the HVAC system to ensure it’s in good working condition.

- Look for any water damage or mold, which can be costly to remediate.

- Check the plumbing for leaks or clogs that may need attention.

Understanding Home Appraisal

An appraisal is an assessment of the property’s value conducted by a licensed appraiser. The appraisal value can impact your buying decision, as it determines how much the lender is willing to finance based on the property’s worth.

- The appraiser considers factors such as the property’s location, size, condition, and comparable sales in the area.

- If the appraisal comes in lower than the agreed-upon purchase price, you may need to renegotiate with the seller or come up with additional funds to cover the difference.

- A higher appraisal value can give you confidence that you’re paying a fair price for the property.

Budgeting for Additional Costs

When buying a home for the first time, it’s crucial to budget for more than just the purchase price. There are several additional costs that you need to consider to ensure a smooth and successful home buying process.

Common Additional Expenses

- Closing Costs: These typically range from 2% to 5% of the purchase price and cover fees for services like appraisal, title search, and loan origination.

- Repairs: It’s common to encounter repairs or renovations that need to be done once you move in. Budgeting for these unexpected expenses is essential.

- Maintenance: Owning a home comes with ongoing maintenance costs such as lawn care, HVAC servicing, and general upkeep. Make sure to include these in your budget.

Pro tip: It’s wise to set aside a contingency fund for any unforeseen expenses that may arise during the home buying process.

Effective Budgeting Tips

- Do Your Research: Get quotes for potential closing costs and repairs in advance to have a realistic idea of how much you need to budget.

- Create a Spreadsheet: Keep track of all your expenses and allocate funds accordingly to avoid any financial surprises.

- Consult with Professionals: Talk to a financial advisor or a real estate agent to get insights on how to budget effectively for additional costs.

Long-Term Financial Planning

Buying a home is a significant financial commitment, and long-term financial planning is crucial to ensure you can comfortably manage your ongoing expenses and build wealth over time.

Managing Mortgage Payments

- Make timely mortgage payments to avoid late fees and protect your credit score.

- Consider making extra payments towards your principal to reduce the overall interest paid over the life of the loan.

- Refinance your mortgage if interest rates drop significantly to potentially lower your monthly payments.

Managing Insurance Costs

- Regularly review your homeowner’s insurance policy to ensure adequate coverage and look for potential discounts.

- Consider bundling your home insurance with auto or other policies to save money on premiums.

- Shop around for insurance quotes periodically to ensure you’re getting the best rates.

Building Home Equity

- Make home improvements that increase the value of your property, such as kitchen or bathroom renovations.

- Regularly maintain your home to prevent costly repairs and preserve its value.

- Consider paying more towards your mortgage principal to build equity faster.