Real Estate Investment Tips: Kicking off with some key advice on how to navigate the world of real estate investments like a pro. From understanding the importance of location to managing rental properties effectively, get ready to up your investment game.

Importance of Real Estate Investment: Real Estate Investment Tips

Real estate investment is a popular choice for many individuals looking to grow their wealth and secure their financial future. The benefits of investing in real estate are numerous, making it a lucrative option for those willing to take the plunge.

Stability and Appreciation

Real estate investments offer stability and the potential for long-term appreciation. Unlike other investments that can be volatile, real estate tends to hold its value over time and can even increase in worth.

- Properties in desirable locations tend to appreciate in value over time, allowing investors to build wealth passively.

- Even during economic downturns, real estate investments can provide a steady income through rental properties.

- Historically, real estate has shown a consistent upward trend in value, making it a reliable investment option.

Diversification and Passive Income

Investing in real estate allows individuals to diversify their investment portfolio and generate passive income streams. By owning rental properties or investing in real estate investment trusts (REITs), investors can earn consistent returns without actively managing their investments.

- Real estate provides a hedge against inflation, as property values and rental income tend to increase with rising prices.

- Generating passive income through rental properties can provide financial stability and supplement other sources of income.

- Investing in REITs allows investors to access the real estate market without the need to directly own properties, providing diversification and liquidity.

Examples of Successful Real Estate Investments

Numerous successful real estate investors have built substantial wealth through strategic property acquisitions and smart investment decisions. Some well-known examples include:

- Donald Trump, who built a real estate empire through commercial and residential properties in New York City.

- Barbara Corcoran, who turned a $1,000 loan into a multimillion-dollar real estate business by investing in residential properties.

- Robert Kiyosaki, author of “Rich Dad Poor Dad,” who advocates for real estate investment as a path to financial independence and wealth building.

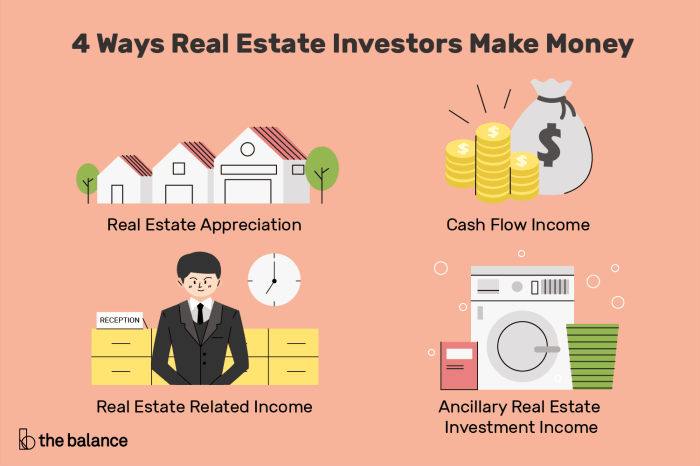

Types of Real Estate Investments

Investing in real estate offers a variety of options, each with its own set of risks and rewards. Let’s explore the different types of real estate investments and examples of successful ventures in each category.

Residential Real Estate

Residential real estate involves properties such as single-family homes, condos, townhouses, and vacation rentals. The main advantage of investing in residential properties is the steady demand for housing. Successful investors often look for properties in desirable locations with high rental potential. For example, purchasing a rental property in a growing neighborhood can lead to significant rental income and long-term appreciation.

Commercial Real Estate, Real Estate Investment Tips

Commercial real estate includes office buildings, retail spaces, hotels, and warehouses. Investing in commercial properties can offer higher returns but also comes with higher risks. Successful commercial real estate investors focus on factors like location, tenant quality, and market trends. An example of a successful commercial real estate investment is purchasing a retail space in a busy shopping district that attracts high foot traffic, leading to increased rental income and property value.

Industrial Real Estate

Industrial real estate comprises properties like factories, warehouses, and distribution centers. Investing in industrial properties can provide stable cash flow and long-term appreciation. Successful industrial real estate investors often target properties located near major transportation hubs or in areas with high demand for industrial space. For instance, acquiring a warehouse in a strategic location close to a port can result in consistent rental income from logistics companies and manufacturers.

Factors to Consider Before Investing

Before diving into real estate investments, it is crucial to consider several key factors that can significantly impact your decisions. Market trends, location, market demand, and property condition are all essential aspects to evaluate before making any investment moves.

Market Trends Impact

Market trends play a pivotal role in real estate investments, as they can dictate the overall profitability of your ventures. Keeping an eye on market trends such as interest rates, housing supply and demand, and economic indicators can help you make more informed decisions.

Importance of Location

Location is often cited as one of the most critical factors in real estate investments. A property’s location can determine its value, potential for appreciation, and demand in the market. Investing in prime locations with good access to amenities and infrastructure can lead to higher returns on your investments.

Market Demand Analysis

Analyzing market demand is crucial before investing in real estate. Understanding the needs and preferences of potential buyers or renters in a specific market can help you tailor your investment strategy to meet those demands. This can ultimately lead to higher occupancy rates and better rental income.

Property Condition Assessment

Assessing the condition of a property is essential to avoid unexpected costs and issues down the line. Conducting thorough inspections, considering maintenance and renovation costs, and ensuring the property meets all safety and quality standards are all critical steps in the investment process.

Financing Real Estate Investments

Real estate investments often require financing to make them a reality. There are various options available for investors looking to fund their real estate ventures. Understanding the pros and cons of different financing methods is crucial in making informed decisions. Calculating potential returns and risks associated with financing options is essential for successful real estate investments.

Different Financing Options

- Traditional bank loans: This is a common option where investors borrow money from banks to fund their real estate projects. The terms and interest rates may vary depending on the lender.

- Hard money loans: These are short-term loans provided by private investors or companies. They typically have higher interest rates but offer faster approval and funding.

- Private money lenders: Investors can also borrow money from individuals or private companies. The terms are usually more flexible compared to traditional bank loans.

Pros and Cons of Using Leverage

- Pros:

Using leverage can amplify returns on investment, allowing investors to control a larger asset with a smaller initial investment.

It can also help diversify a real estate portfolio and increase potential profits.

- Cons:

High leverage can increase risks and lead to financial instability if the investment does not perform as expected.

Interest payments and debt obligations can eat into profits, especially during market downturns.

Calculating Returns and Risks

- Return on Investment (ROI): This is a crucial metric for evaluating the profitability of a real estate investment. It is calculated by dividing the net profit by the total investment cost and expressing it as a percentage.

- Risk Assessment: Investors should consider factors such as market conditions, rental yields, vacancy rates, and potential capital appreciation when assessing the risks associated with financing options.

Tips for Successful Real Estate Investment

Investing in real estate can be a lucrative venture if done correctly. Here are some tips to help you succeed in real estate investment:

Finding Profitable Real Estate Deals

When looking for profitable real estate deals, consider the following strategies:

- Search for distressed properties or foreclosures that can be purchased below market value.

- Network with real estate agents, wholesalers, and other investors to uncover off-market deals.

- Analyze market trends and growth potential in different neighborhoods to identify areas with high appreciation rates.

Importance of Due Diligence

Due diligence is crucial in real estate investment to minimize risks and maximize returns. Here are some tips to ensure thorough due diligence:

- Conduct property inspections to assess the condition and potential repair costs.

- Review property history, including title search, liens, and zoning regulations.

- Analyze rental income potential and vacancy rates in the area before making a purchase.

Managing Rental Properties Effectively

Managing rental properties requires careful attention to detail and proactive communication with tenants. Here are some tips for effective property management:

- Screen tenants thoroughly to ensure they are reliable and responsible.

- Maintain the property regularly to preserve its value and attract quality tenants.

- Respond promptly to tenant requests and address maintenance issues promptly to maintain tenant satisfaction.