Real Estate Investing Tips takes center stage in this guide, offering a fresh perspective on maximizing your investments in the real estate market. Get ready to dive into the world of real estate with expert advice tailored for success.

Whether you’re a seasoned investor or just starting out, these tips will help you navigate the complex world of real estate investing with confidence.

Introduction to Real Estate Investing

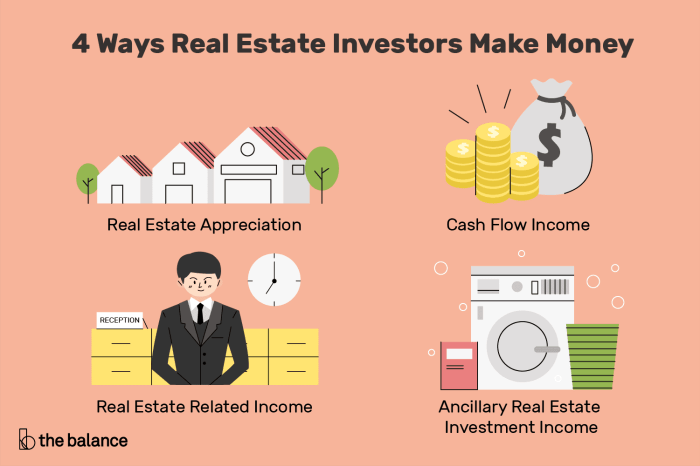

Real estate investing involves purchasing, owning, managing, renting, or selling real estate for profit. It is a popular form of investment due to its potential for long-term growth and passive income generation.

Significance of Real Estate Investing

- Real estate provides a tangible asset that typically appreciates over time, offering potential for wealth accumulation.

- Investing in real estate can diversify your investment portfolio, reducing risk compared to investing solely in stocks or bonds.

- Real estate investments can generate passive income through rental properties, providing a steady cash flow.

Benefits of Investing in Real Estate

- Income Generation: Rental properties can provide a consistent income stream, especially in high-demand rental markets.

- Appreciation: Real estate properties have the potential to increase in value over time, allowing investors to build equity.

- Tax Benefits: Real estate investors can take advantage of tax deductions, such as mortgage interest, property taxes, and depreciation.

Examples of Successful Real Estate Investors

- Donald Bren: Known as the wealthiest real estate developer in the U.S., Bren built his fortune through strategic investments in commercial properties.

- Barbara Corcoran: A prominent real estate investor and TV personality, Corcoran founded The Corcoran Group and has made successful investments in various properties.

- Robert Kiyosaki: Best-selling author of “Rich Dad Poor Dad,” Kiyosaki advocates for real estate investing as a path to financial independence and wealth creation.

Types of Real Estate Investments

Real estate investments come in various forms, each with its own set of advantages and disadvantages. Let’s explore the different types to help you make informed decisions on where to invest your money.

Residential Real Estate

Residential real estate involves properties like single-family homes, condos, townhouses, and apartment buildings. Investors can generate income through rental payments from tenants. One advantage is the steady demand for housing, but drawbacks include dealing with tenant turnover and property maintenance. Examples of properties suitable for residential investment include a duplex in a suburban neighborhood or a condo in a bustling city center.

Commercial Real Estate

Commercial real estate includes office buildings, retail spaces, and industrial properties. Investors can benefit from longer lease terms and potentially higher rental income. However, economic downturns can impact businesses, leading to vacancies. Suitable properties for commercial investment include a shopping mall in a prime location or an office building in a business district.

Industrial Real Estate

Industrial real estate comprises warehouses, distribution centers, and manufacturing facilities. Investors can capitalize on the growing e-commerce industry and demand for logistics spaces. Challenges include specialized knowledge required for property management and potential environmental risks. Properties ideal for industrial investment include a large warehouse near a major transportation hub or a manufacturing plant in an industrial park.

Financial Considerations in Real Estate Investing

When it comes to real estate investing, understanding the financial aspects is crucial for success. From calculating return on investment to managing finances effectively, here are some key considerations to keep in mind.

Calculating Return on Investment (ROI)

Calculating ROI is essential to determine the profitability of a real estate investment. The formula for ROI is:

ROI = (Net Profit / Cost of Investment) x 100

Net profit includes rental income, property appreciation, and any other income generated from the investment. The cost of investment includes the purchase price, closing costs, and any renovation expenses. A higher ROI indicates a more profitable investment.

Financing Options for Real Estate Investments

There are several financing options available for real estate investments, including:

- Traditional mortgages from banks or credit unions

- Hard money loans for quick financing

- Private money lenders for flexible terms

- Crowdfunding platforms for investment pooling

Each financing option has its pros and cons, so it’s essential to choose the one that aligns with your investment goals and financial situation.

Budgeting and Managing Finances for Real Estate Investments

Effective budgeting and financial management are key to long-term success in real estate investing. Some tips to help you manage your finances include:

- Create a detailed budget that accounts for all expenses and income

- Set aside a contingency fund for unexpected repairs or vacancies

- Regularly review and adjust your budget to ensure financial stability

- Consider working with a financial advisor or accountant for expert guidance

By staying on top of your finances and making informed decisions, you can maximize the profitability of your real estate investments.

Tips for Finding Investment Properties

Finding lucrative investment properties can be a key factor in successful real estate investing. Here are some tips to help you in your search:

Importance of Location, Real Estate Investing Tips

Location is crucial when it comes to real estate investing. A property’s location can greatly impact its value and potential for appreciation. Look for properties in desirable neighborhoods with good schools, low crime rates, and easy access to amenities like shopping, dining, and transportation.

Working with Real Estate Agents and Brokers

Real estate agents and brokers can be valuable resources in your search for investment properties. They have access to listings that may not be available to the general public and can help you navigate the buying process. Be sure to find an agent or broker who is experienced in working with investors and understands your investment goals.

Property Management and Maintenance: Real Estate Investing Tips

Property management is a crucial aspect of real estate investing as it involves overseeing and maintaining properties to ensure they retain or increase their value over time. Effective management can lead to higher returns on investment and better tenant satisfaction.

Tips for Maintaining and Improving Investment Properties

- Regular Inspections: Conduct routine inspections to identify any maintenance issues early on and address them promptly.

- Upkeep of Exterior: Maintain curb appeal by landscaping, painting, and repairing any exterior damage to attract tenants and preserve property value.

- Appliance Maintenance: Ensure all appliances are in good working condition by scheduling regular maintenance checks to prevent costly repairs or replacements.

- Responsive Communication: Stay in regular communication with tenants to address any concerns or maintenance requests promptly, fostering a positive landlord-tenant relationship.

Dealing with Tenants and Property Maintenance Challenges

- Clear Communication: Clearly Artikel expectations, responsibilities, and procedures in the lease agreement to avoid misunderstandings and conflicts.

- Handling Tenant Complaints: Address tenant complaints or concerns promptly and professionally to maintain a positive relationship and prevent issues from escalating.

- Emergency Response Plan: Have an emergency response plan in place for urgent maintenance issues or tenant emergencies to ensure swift and effective resolution.

- Professional Help: Consider hiring a property management company or professionals for complex maintenance tasks or if managing multiple properties becomes overwhelming.

Risks and Mitigation Strategies in Real Estate Investing

Investing in real estate comes with its own set of risks, but with proper strategies, these risks can be mitigated effectively.

Common Risks in Real Estate Investing

- Market Fluctuations: Real estate values can be influenced by economic conditions, interest rates, and local market trends.

- Vacancy Rates: Empty properties can lead to financial losses due to lack of rental income.

- Property Damage: Natural disasters or unexpected maintenance issues can impact the value of your investment.

- Regulatory Changes: New laws or regulations can affect property values or rental income.

Mitigation Strategies

- Research and Due Diligence: Thoroughly investigate the market and property before investing to understand potential risks.

- Diversification: Spread your investments across different property types or locations to reduce overall risk exposure.

- Insurance: Purchase appropriate insurance coverage to protect against property damage or liability claims.

- Reserve Funds: Maintain a financial buffer for unexpected expenses or periods of vacancy.

Building a Diversified Portfolio

- Consider Different Property Types: Invest in residential, commercial, or industrial properties to diversify your portfolio.

- Explore Various Locations: Look for properties in different neighborhoods or cities to minimize risk from regional market fluctuations.

- Utilize Different Investment Strategies: Mix long-term rentals, short-term rentals, and fix-and-flip properties to balance your risk exposure.

- Consult with Professionals: Work with real estate agents, property managers, and financial advisors to gain insights and expertise in building a diversified portfolio.