Customer Acquisition Cost, or CAC, is the key to unlocking successful marketing strategies and business growth. Dive into the world of CAC with us as we explore its calculation, factors affecting it, and strategies to reduce it. Get ready for a journey filled with insights and tips to enhance your marketing game!

Definition of Customer Acquisition Cost

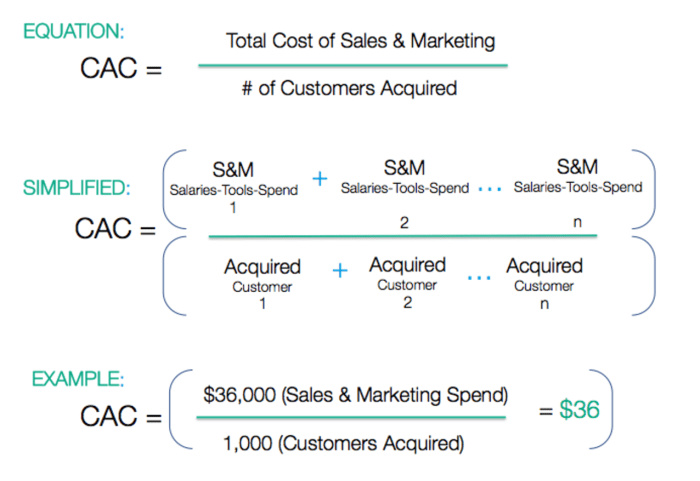

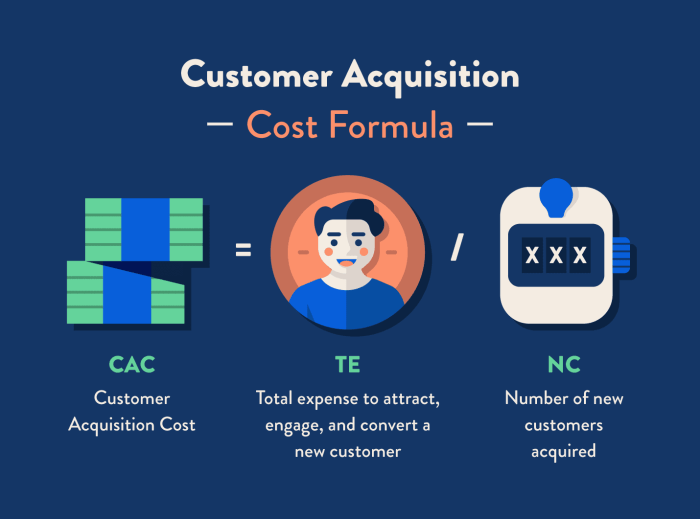

Customer Acquisition Cost (CAC) is the amount of money a business spends on acquiring a new customer. It is a crucial metric for determining the effectiveness of a company’s marketing and sales strategies. By understanding CAC, businesses can make informed decisions on how to allocate resources and improve their overall profitability.

Calculating CAC in Different Industries

- In the e-commerce industry, CAC can be calculated by dividing the total marketing and sales expenses by the number of new customers acquired during a specific period.

- For subscription-based businesses, CAC can be determined by dividing the total cost of acquiring customers (such as advertising and sales expenses) by the number of new subscribers gained.

- In the software industry, CAC calculation may involve factoring in the cost of sales and marketing campaigns that led to customer acquisition, divided by the number of new customers acquired.

Significance of Understanding CAC for Effective Marketing Strategies

- Knowing the CAC helps businesses evaluate the efficiency of their marketing campaigns and sales efforts.

- By understanding CAC, companies can focus on strategies that bring in high-value customers and optimize their return on investment.

- Tracking CAC over time allows businesses to identify trends and adjust their marketing strategies to improve customer acquisition and retention.

Factors Affecting Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), several key factors play a significant role in determining this crucial metric for businesses. Let’s dive into the factors that influence CAC and understand their impact on a company’s bottom line.

Customer Behavior

Customer behavior plays a vital role in influencing CAC. The way customers interact with a brand, their preferences, purchasing patterns, and loyalty all impact how much it costs to acquire and retain them. Understanding customer behavior can help businesses tailor their marketing strategies effectively, reducing CAC in the long run.

Market Competition

Market competition is another crucial factor that affects CAC. In highly competitive industries, businesses often need to invest more in marketing and advertising to stand out from the crowd and attract customers. This increased competition can drive up CAC as companies vie for the attention of the same target audience.

Product Pricing

Product pricing directly impacts CAC, as it affects the overall revenue generated from each customer. Lower-priced products may lead to higher acquisition costs, as more customers need to be acquired to make up for the lower margins. On the other hand, higher-priced products may result in lower CAC but require a more targeted approach to attract customers willing to make a larger investment.

Understanding the interplay between customer behavior, market competition, and product pricing is essential for optimizing CAC and maximizing customer lifetime value.

Strategies to Reduce Customer Acquisition Cost

When it comes to lowering Customer Acquisition Cost (CAC) while maintaining customer acquisition quality, businesses must implement effective techniques to optimize their marketing efforts. One key strategy is to focus on targeted marketing campaigns that reach the right audience with personalized messages. Additionally, optimizing conversion rates can positively impact CAC by increasing the number of customers acquired from the same marketing spend.

Role of Targeted Marketing Campaigns

Targeted marketing campaigns play a crucial role in reducing CAC by ensuring that marketing efforts are directed towards the most relevant audience segments. By identifying and targeting specific demographics, interests, or behaviors, businesses can increase the efficiency of their marketing campaigns and improve the likelihood of acquiring high-quality customers. This approach helps reduce wasted resources on uninterested leads and allows for a more personalized and engaging customer experience.

Optimizing Conversion Rates

Optimizing conversion rates is another effective way to lower CAC. By improving the efficiency of the sales funnel and enhancing the customer journey, businesses can increase the number of leads that convert into paying customers. This can be achieved through A/B testing, website optimization, and targeted messaging that resonates with the audience. By focusing on improving conversion rates, businesses can acquire more customers without significantly increasing their marketing spend, thus reducing CAC and maximizing ROI.

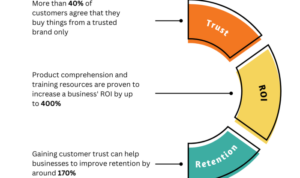

Calculating Return on Investment (ROI) from Customer Acquisition Cost

In the world of business, calculating Return on Investment (ROI) from Customer Acquisition Cost (CAC) is crucial for understanding the effectiveness of marketing and sales efforts. ROI helps businesses determine how much revenue they are generating from the money spent on acquiring new customers.

Process of Calculating ROI from CAC, Customer Acquisition Cost

To calculate ROI from CAC, you can use the following formula:

ROI = (Revenue – Cost of Goods Sold – CAC) / CAC

This formula takes into account the revenue generated, cost of goods sold, and the customer acquisition cost to determine the return on investment.

Examples of Analyzing CAC Investments

- Company A spent $10,000 on marketing and sales efforts to acquire new customers. They generated $50,000 in revenue from these customers. Using the formula, the ROI would be calculated as follows:

ROI = ($50,000 – $0 – $10,000) / $10,000 = 4

This means that for every dollar spent on acquiring customers, Company A generated $4 in revenue.

- Company B invested $5,000 in customer acquisition and generated $15,000 in revenue. Calculating the ROI:

ROI = ($15,000 – $0 – $5,000) / $5,000 = 2

Company B saw a return of $2 for every dollar spent on acquiring new customers.

Importance of Monitoring ROI for Improving Strategies

Monitoring ROI is essential for businesses to identify which marketing and sales strategies are working effectively and which ones are not. By tracking ROI from CAC, companies can make informed decisions on where to allocate resources for maximum return. This data-driven approach helps optimize marketing campaigns, improve customer acquisition tactics, and ultimately boost profitability.